Hi, my name is Lynn Condo, and I work in JMU in the Student Advice Team. My job is related to student funding. I'm the Student Forms Manager, so we give advice and guidance about a range of student funding. If you're from a lower-income household, you will get more free money, grants, and bursaries than if you're from a higher-income household. If you're from a low-income household, you would get the maximum grant that's available. In 2013, the figure for England was just £3,354 per year in grant, and that income is £25,000. So if your household income is £25,000 or less, you'd get the maximum grant. Also, from a low-income family, you would get all the funding from the University. JMU has got a bursary of £500 a year. So if you're on a three-year course, that's £1,500 over the three years. You get £500 a year, and that's given to you free for you to do whatever you want with, like music, books, or travel. Another initiative for students from low-income families is the National Scholarship Program. So at JMU, you would need to have a household income of £16,000 or less. We're also looking for students with around 280 UCAS points from the three units at A2 level. That could be BTEC, but also the equivalent in university, maybe a mature student coming from an access course. Although they don't have UCAS points attached, we would look at all the evidence. So maybe you could get a reference from your tutor. The National Scholarship Program is worth £3,000. That's a great initiative, and you get £2,000 of your fees and £1,000 cash. It's just the first year, so for example, in your first year, your tuition fee would be reduced to £7,000. You would get £1,000 cash...

Award-winning PDF software

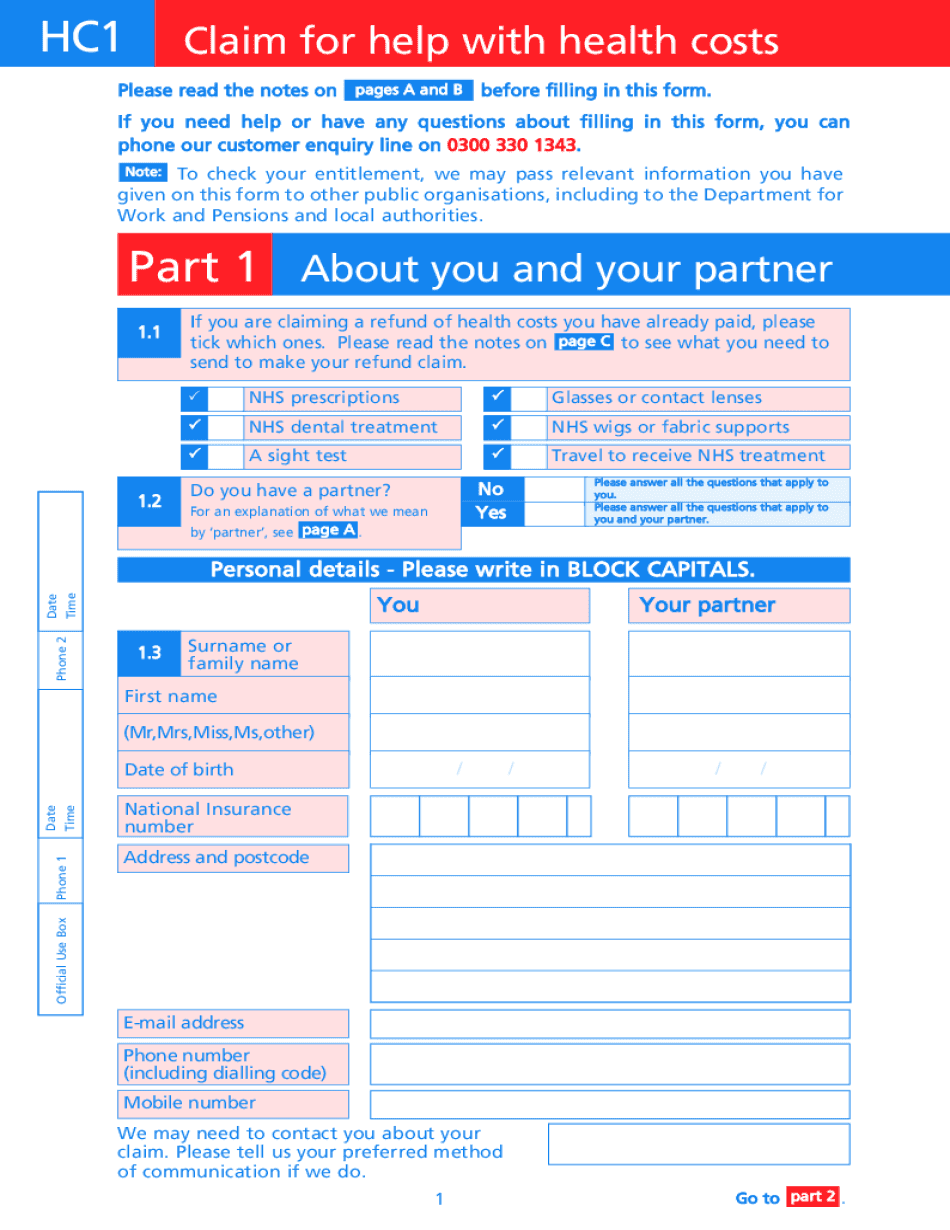

Hc1 international student Form: What You Should Know

This is not the case for fringe benefits, whether in the Davis Bacon Act or as supplemental pays.) But as we saw in the article above, Davis Bacon has a specific rule about the fringe benefits listed in the wage determination; namely, they must pay the rate set by the prevailing wage law. This means the employer can pay fringe benefits at a rate set by the law — either. As long as the fringe benefits are paid on a piece-rate basis, as we pointed out in our previous article, and are not supplemental provides, the employer only has to pay the required wages to the workers listed on the Wage Payment Notice on the last day of the month. They are no longer subject to the Davis Bacon Act's fringe benefits rules. Fringe Benefits as Additional Cash wages Let's walk through this and look at what's going on when you provide fringe benefits as additional cash wages. To make a point, let's suppose that you, as a subcontractor, are getting paid an hourly wage of 10 an hour. You are eligible to pay your employee an additional 5 in fringe benefits as extra cash wages. How do you do this? As the subcontractor, you should pay the 5 to your subcontractor employee, who is also entitled to receive the 15 per hour wage. Since your subcontractor employee is not eligible for the 15 per hour wage, you have to use the other 5. That means, your subcontractor employee is eligible to receive the extra cash wages, plus a 5 cash wage for his or her part-time employment. Your total 25 cash wages from the extra 5 in fringe benefits is your “bonus” as a bonus under Davis Bacon, not your actual 32 an hour hourly wage. So, you've provided 25 in extra cash to your subcontracting employee. When you pay a fee to Davis Bacon, we calculate this bonus as a gross fee, not as a cash-wages payment. For that reason, you will be given just 3.5% of your gross fee, or .15%. So, we have to report all of your supplemental cash wages as wages and not as fringe benefits. As you know, only the employee that pays the fee is entitled to receive the benefits. Here are some rules that govern payments, including fringe benefits: Workers entitled to fringe benefits can be paid only when they work.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Hc1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Hc1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Hc1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Hc1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Hc1 Form international student