Welcome to another video from explaining computers. In this video, I'm going to talk about n disk or ten disks. You cry well, M disk is a relatively new kind of writable Blu-ray and DVD media that stores your data securely for long period of time. Now as you may know, traditional DVD and Blu-ray and CD discs if you write data to them, it can be gone in a few years. It can be gone a few months if you're unlucky, and they aren't particularly good discs but with n disc the data is supposed to be secured on the disk once you've written it for centuries if not a thousand years now. You might be thinking how, so what's the difference? Well, the difference is traditional writable media store the data using an organic die whose properties are changed by a laser that dies candy generate over time within m disc your data is stored using an inorganic what they call rock light layer into which the data is in grade and that's supposed to have much greater longevity. So in this video, I'm going to show you some M disk hardware and media with a test them out test compatibility. After that, I'm going to do some very intensive data retention tests. I thought I'd show you Maya m-disc KIT. What was a special time diskette you cry cool? So isn't this just a stuff I bought to get me into using m-disc? Let's have a look at some of this. First, let's start with the media. I've got some official millennium Artur m-disc BDR discs. These are 25 gigabyte discs which store 25 gigabytes on the end disc. There three of these in the package with that nice little um slimline cases. Let's get into that see what they're...

PDF editing your way

Complete or edit your help with health cost hc1 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export hc1 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your help with health costs hc1 form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your hc1 claim for help with health costs by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Hc1

About Form Hc1

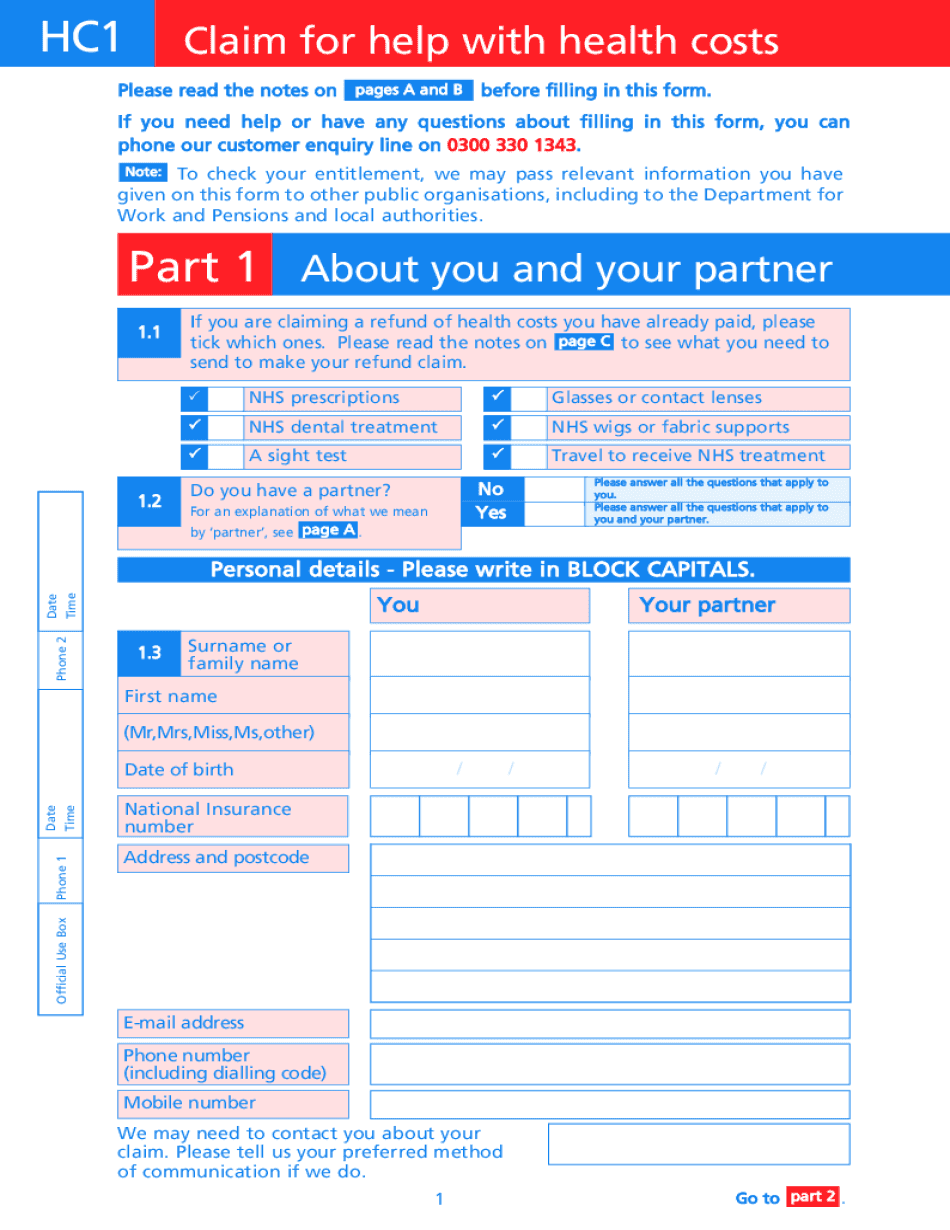

Form HC1 is a form used to apply for help with health costs in the United Kingdom. It is also known as the NHS Low Income Scheme. The form is used to apply for assistance with the costs of prescription charges, dental treatments, eye care, and travel to receive NHS treatment. Those who need the HC1 form are individuals who have a low income and may struggle to pay for their healthcare costs. This includes people who are on benefits, low-income workers, and those who are self-employed but earning a low income. People with certain medical conditions or disabilities may also be eligible for assistance through the NHS Low Income Scheme. Applicants for the HC1 form must provide details of their income, employment status, family size, and any health conditions or disabilities they may have. Based on this information, the NHS will determine whether they are eligible for help with health costs and what level of assistance they will receive.

What Is Hc1 Form?

Hc1 Form is a document to claim for help with health and travel costs.

It is quite useful for different purposes. For example:

- Dental treatment

- Travel to hospital

- Sight tests, glasses and contact lenses

It is also helpful while asking for the cost help for Prison Visits and expenses connected with this.

You may claim help for yourself, your partner, children whenever you need it.

There are several moments that prevent you from claim.

- It is impossible to obtain the help in case you or your partner have certain amount of money.

- £16,000 in property, or savings (without considering the place where you live)

- £23,250 in property or savings in case you live permanently in a care home.

2. You are already eligible for help with health costs if you or your partner are receiving income support, income-based job seeker’s allowance, income-related employment and support allowance, pension credit guarantee credit.

What to write in the Hc1 Form?

Be attentive and accurate while filling this form out. Read the instruction below to clarify the list of necessary information.

- Specify your personal full data. It is important to indicate whether you have a partner and prinformation about him or her. Mention any income and savings that you have together.

- In case, you are working or getting an education you need to previdence of your income.

- Put the current date

- Sign the document

Once you completed the form you may print it or send online.

Online options make it easier to organize your document management and supercharge the productivity of your workflow. Adhere to the short tutorial in an effort to carry out Form Hc1, keep clear of mistakes and furnish it in a well timed manner:

How to accomplish a Form Hc1 on the net:

- On the web site along with the type, click Get started Now and go to the editor.

- Use the clues to complete the relevant fields.

- Include your personal info and speak to data.

- Make certain that you enter proper info and quantities in acceptable fields.

- Carefully examine the subject material from the sort too as grammar and spelling.

- Refer that will help segment if you have any inquiries or address our Aid workforce.

- Put an digital signature in your Form Hc1 along with the guidance of Indication Device.

- Once the form is done, press Done.

- Distribute the ready form by means of e-mail or fax, print it out or save on your system.

PDF editor permits you to make improvements towards your Form Hc1 from any web connected machine, personalize it in keeping with your needs, sign it electronically and distribute in different strategies.

What people say about us

Take advantage of an expert form-filler

Video instructions and help with filling out and completing Form Hc1