Award-winning PDF software

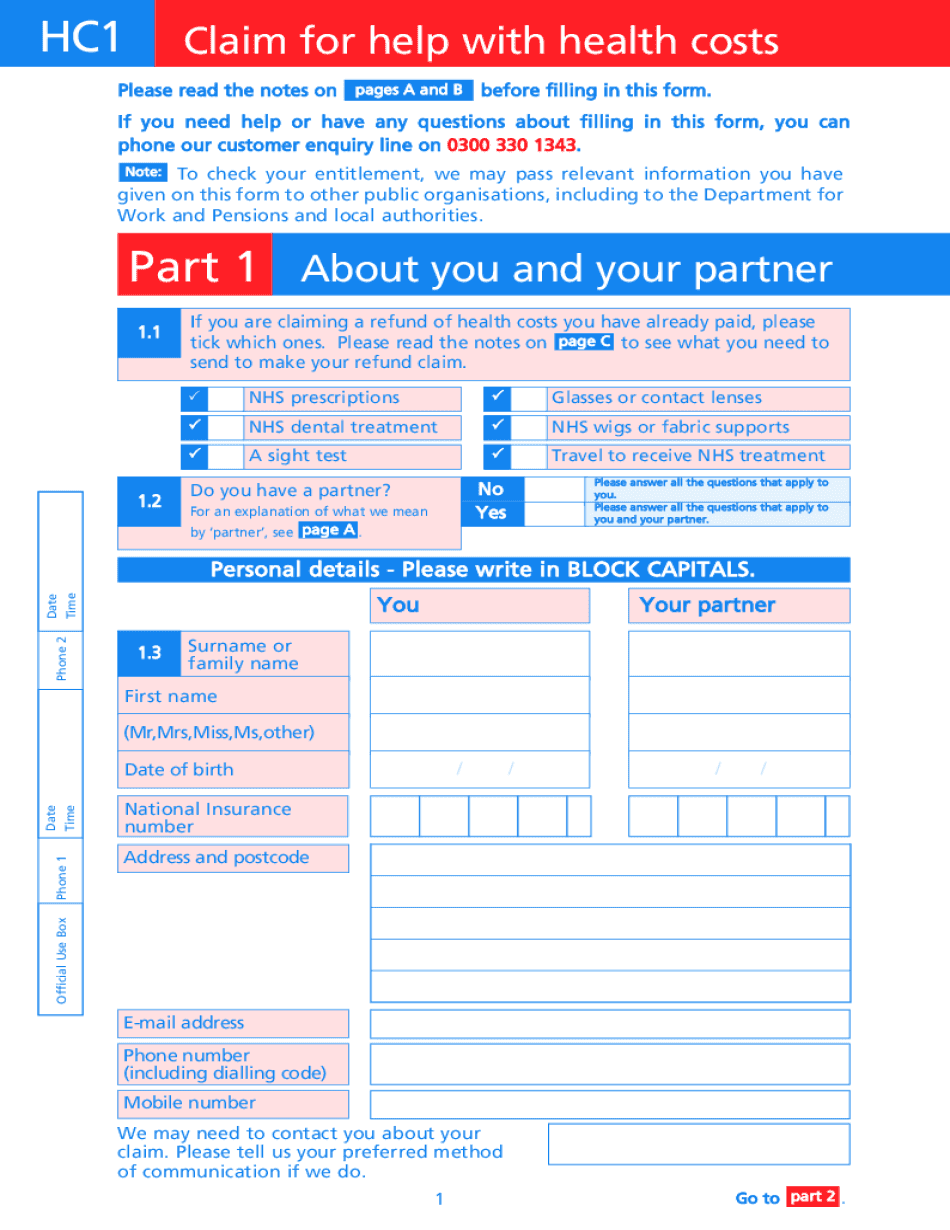

Hc1 Claim For Help With Health Costs: What You Should Know

Fiscal Receipts in electronic form Internal Revenue Service is the authorized tax payment agent of the United States Government. The processing of this form is related to internal revenue procedures and the proper payment of taxes. The IRS has developed this processing system to provide the auditors and investigators of the Internal Revenue Service with a means of easily tracking the actual money, including those received as tax refunds or through refundable credits. This payment information is used by the IRS and other tax payment agents to better service its customers. This electronic tax payment system also facilitates the electronic exchange of information among various enforcement agencies as well as with the Department of Justice and other Federal entities. This electronic payment system is provided to the taxpayers and to each other with the purpose of providing timely access to the payment of taxes and any other required documents. It allows the taxpayer to receive payment directly into their bank account, from any Federal, State, or foreign financial institution, or from third parties. The electronic payment system is designed to ensure a fair, accurate and expedient payment of taxes to individuals, organizations, and entities who may be difficult to reconcile with their original filing statements. A person or an organization may pay taxes with his/her bank, credit union, or credit card using a debit or credit card number. The electronic payment system is not intended to replace the requirements for paper and signed paper tax payment records. The electronic information is for informational and administrative purposes only. Payments are provided in the manner and with the features agreed upon by the taxpayer and Internal Revenue Service. The Electronic Payment System is the sole and exclusive means of transmitting, recording, and receiving payments of U.S. and non-U.S. tax information. This electronic payment system shall not be used, in any manner, to circumvent or circumvent this agreement and to avoid any consequences arising out of the use of this electronic payment system. For example, this electronic payment system may not be used to: The electronic payment system shall not be used to make payments other than as follows: The Electronic Transaction Number (ITE) is required on all electronic payment transactions, e.g., check for payment, bank deposit from a U.S. bank account, or payment of credit card balance.

Online systems help you to to organize your doc management and supercharge the productiveness of your workflow. Adhere to the quick guidebook with the intention to complete HC1 Claim for help with health costs, steer clear of mistakes and furnish it in the timely method:

How to accomplish a HC1 Claim for help with health costs on the internet:

- On the web site with the kind, click Begin Now and go on the editor.

- Use the clues to fill out the appropriate fields.

- Include your individual material and speak to data.

- Make certain that you choose to enter accurate facts and numbers in proper fields.

- Carefully check the subject material in the variety likewise as grammar and spelling.

- Refer to help part when you have any inquiries or handle our Assist team.

- Put an digital signature on your own HC1 Claim for help with health costs when using the guidance of Indicator Software.

- Once the form is concluded, press Carried out.

- Distribute the completely ready sort by way of email or fax, print it out or save on your own system.

PDF editor helps you to make adjustments towards your HC1 Claim for help with health costs from any net connected device, customise it in keeping with your preferences, indication it electronically and distribute in different means.